A 5 Minute Overview Of

The Customer-Funded Business

Start, Finance, or Grow Your Company with Your Customers' Cash

About the Author

John Mullins is associate professor of management practice, marketing and entrepreneurship at the London School of Business. He is also a successful entrepreneur having founded two companies (one of which went public) and consulted with a variety of organizations including Merck-Serono, Time Warner Communications and the Young President's Organization. He is the author or coauthor of two best-sellers, The New Business Road Test and Getting to Plan B (written with venture capitalist Randy Komisar). He is a graduate of the University of Minnesota, Stanford University and Lehigh University.

The Main Idea

Since time immemorial, the accepted approach to securing start-up funding has generally been:

That's all well and good but the odds of getting funded that way are not that great. Out of the 5 million ventures which seek startup funding each year in the United States alone, only about 1,500 will get funded by venture capitalists and another 50,000 will be funded by angel or other investors. Seeking start-up funding the conventional way is hard work.

A much better approach is to forget about securing venture capital entirely and instead get your future customers to fund your startup. If you can find enough customers who will pay you good money (ideally in advance) for the solution to their problems you're in the process of creating, then you won't need to raise capital anywhere else.

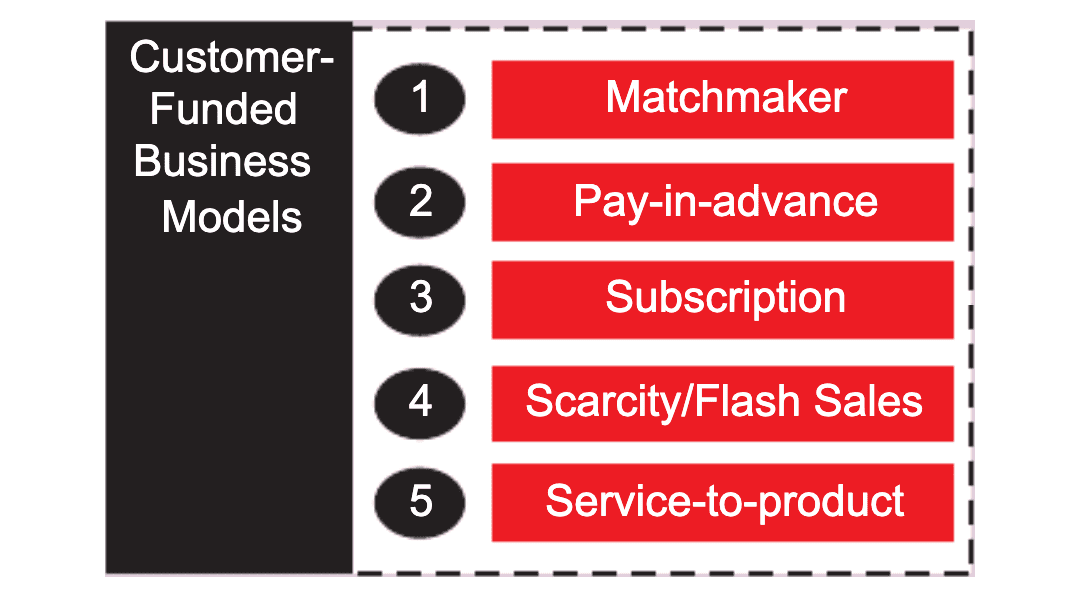

There are in fact five viable customer-funded business models you can use:

To get start-up funding, don't go looking for investors. Find a pool of customers who want what you plan on selling and get them to fund you. It's a much better way to go.

The best money comes from customers, not investors. Selling a product or service early in the life of a company provides great feedback and the cash needed to refine the idea.

Sections in this Books

The Advantages of Customer Funding. Raising capital is always hard work and the problem is while you do that, you focus on what investors want rather than on your customers. A much better way to start, finance and then grow your business is to use your customer's cash, not an investor's money. This offers some compelling advantages.

Model #1 — Matchmaker. The matchmaker business model is where you create a way to match buyers and sellers. You generate the order or the transaction without assuming ownership of the goods yourself and get paid a fee for doing so. The matchmaker model requires little investment up front and can grow to a substantial size if you get it right.

Model #2 — Pay-in-advance. Pay-in-advance is where the business asks the customer to pay either a deposit or the full price before the product or service is shipped and supplied. The customer's advance payments are then used to finance the business.

Model #3 — Subscription. Widely used in the publishing industry, the subscription business model involves having customers pay an ongoing fee. This is ideal where you deliver something repeatedly over an extended period of time.

Model #4 — Scarcity / Flash Sales. The scarcity business model is where you offer something in limited quantities or for a limited period of time. You use scarcity to get the customer's cash before the goods are delivered, thereby creating negative working capital requirements.

Model #5 — Service-to-product. Service-to-product is where a business starts out providing customized services to a customer and then uses that expertise to deliver a packaged solution which appeals to the broader marketplace. Your initial customer in effect funds the development of your product for you with this business model.

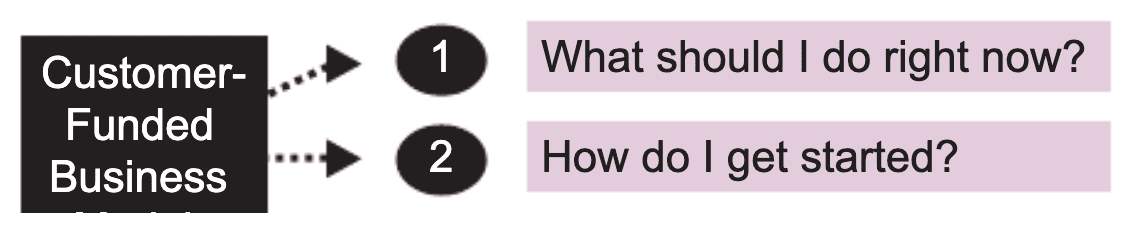

Making Customer Funding Happen. To successfully implement customer funding, there are three questions to work through:

Want in-depth 30-minute summaries?

In addition to this 5-minute overview, Summaries.Com has a premium 30-minute summary of this book and 1,000+ more, to help you advance your career and business.

Check Out Summaries.com Premium Plans Today!Want more 5-minute Snapshots?

To get a new 5-minute business book snapshot each week, sign up for the Summaries.com free plan.

Sign Up for the Summaries.com Free PlanCrowdFunding 101 Collection

If you enjoyed this summary, here is a collection of related business book summaries, to help you get ideas and strategies that will give you an edge over your competition.

These 5 summaries will give you ideas on how to put together a successful crowdfunding campaign on Kickstarter or Indiegogo.

Buy CrowdFunding 101 Collection (5 x 30-Min Summaries)

The Customer-Funded Business

Start, Finance, or Grow Your Company with Your Customers' Cash

by John Mullins

Crowdfunded

The Proven Crowdfunding System for Launching Products, Raising Millions, and Scaling Brands Using Indiegogo and Kickstarter

by Mark Pecota

The Crowdfunding Revolution

Social Networking Meets Venture Financing

by Kevin Lawton and Don Marom

Crowdsourcing

Why the Power of the Crowd is Driving the Future of Business

by Jeff Howe

Launch

An Internet Millionaire's Secret Formula to Sell Almost Anything Online, Build a Business You Love, and Live the Life of Your Dreams

by Jeff Walker